Authored by David Collum, originally posted at Peak Prosperity,

If you've not yet read Part 1, click here to do so. The whole enchilada can be downloaded as a single PDF here, or read below, or viewed in parts via the hot-linked contents as follows:

Part 1:

Part 2:

Wealth Disparity

“Printing money out of thin air does not increase wealth, it only increases claims on existing wealth.”

~Charles Hugh Smith

In the olden days, claims that the rich were getting richer and the poor were getting poorer were a thinly veiled rallying cry for class warfare. Thomas Sowell reminds us that a growing economy lifts all boats, and those at the bottom strata percolate up generationally from garment worker to bookkeeper to doctors and lawyers (well, maybe just doctors). It feels different now, and the angst over wealth disparity resonates with growing numbers of adherents. It is no longer just the dregs of society but the increasingly struggling middle class, or what I prefer to call “the median class.”

“Only the wealthy can afford a middle-class lifestyle.”

~Zero Hedge

The contrasts are stunning. While 53% of adults earn less than $30,000 per year,ref 197 the rentier class—big-gun money managers—are muffin topping out at $3 billion.ref 198,199 David Tepper earned almost $500K per hour. Stevie Cohen ranked second in earnings as a full-time defendant for insider trading. The median retirement savings of a working-age adult is $2,000, yet we've got folks with the cash to pay for brain surgery on goldfish,ref 200 $60 million Steve Martin–like balloon art,ref 201 $500K watches,ref 202 and $2,000 glamburgers (“gluttonburgers”).ref 203 A full 47% of millennials are using >50% of their paychecks to pay down debt.ref 204 Twenty percent of US families have no employed family members.ref 205 This is a problem demanding solutions for which none are obvious. The elite billionaire society, Beta Kappa Phi,ref 206 is dominated by the rentiers rather than wealth-creating capitalists. This is not about Bill Gates or Michael Dell. Wealth inequality is about the inordinately high pay for those who don't actually create wealth and the inordinately low pay for those whose toils do. We have reached the apex of another gilded age.

“It's not just enough to fly in first class; I have to know my friends are flying in coach.”

~Jeremy Frommer, Carlin's chief executive

Seven Habits of Highly Successful People: skiing, yachting, snorkeling, golf, polo, dinner parties, and shopping.

We will be tempted to redistribute. But ramping up the minimum wage by fiat quickly ushers in the 360-burger-per-hour robot.ref 207“Our device isn’t meant to make employees more efficient,” said Momentum co-founder Alexandros Vardakostas. “It’s meant to completely obviate them.” (Note the careful use of “obviate” rather than “replace.”) Debates about whether we should throw money to the rich or money to the poor, however, beg the key question: why are we throwing money at all?

“A smoothly operating financial system promotes efficient allocation of saving and investment.”

~Janet Yellen

Killin' it Janet! But then she went on to make some unfortunate comments suggesting that the poor need to own more assets. Oh well. It is ironic that some (including me) attribute the wild disparity squarely on the Fed.

The economy has been financialized to dysfunction, a hallmark of a failing empire according to Kevin Phillips in American Theocracy. By flooding the market with capital, central bankers have made it difficult for workers to compete with capital-intensive technology. (I hasten to add that I’m unsure where I stand on this point given that creative destruction is central to growth.) The excess capital, however, also renders our hard-earned savings—our capital—worthless. I know where I stand on this point. Why pay savers for use of their capital when the Fed hands it out for free? By driving down rates to zero, the Fed is impoverishing savers unwilling to step out on the risk curve. Those of the median class who spent time out on that risk curve have been generationally wounded and, more important, are broke. They lack the capital to close the gap. Despite claims of impending deflation, the spending power of paychecks for the staples—food, energy, health care, and education—has tanked. Alliance Bernstein does a remarkable job of laying out the almost unattainable goal of a stable retirement.ref 208

“I would say [Fed policy] has been in some sense reverse Robin Hood.”

~Kevin Warsh, Stanford University and former Federal Reserve governor

“Maybe the Fed is delusional about the effects of its policy . . . in widening the gulf between rich and poor in this country.”

~William Cohan

“Part of the impact of these very, very low interest rates is that we've created this disparity. The wealthy are benefiting from government policy and the non-wealthy aren't. We have a president who says we've got to fight this disparity, and we have a Fed who's encouraging it everyday.”

~Sam Zell, former real estate mogul

History shows that ugly things happen when classes start battling for their share of the pie. A McShitstorm hit the McDonalds annual meeting from clashes of cops and protestors.ref 209 Ferguson (see below) is not just about a dead black guy. Models show a high correlation of global riots with global food prices.ref 210 We are there again. Nick Hanauer, a guy who is quite familiar with wealth creation, suggests that the billionaires of the world should be nervous:ref 211

“What everyone wants to believe is that when things reach a tipping point and go from being merely crappy for the masses to dangerous and socially destabilizing, that we’re somehow going to know about that shift ahead of time. Any student of history knows that’s not the way it happens. Revolutions, like bankruptcies, come gradually, and then suddenly. One day, somebody sets himself on fire, then thousands of people are in the streets, and before you know it, the country is burning. And then there’s no time for us to get to the airport and jump on our Gulfstream and fly to New Zealand. That’s the way it always happens. If inequality keeps rising as it has been, eventually it will happen. We will not be able to predict when, and it will be terrible—for everybody. But especially for us.”

~Nick Hanauer, to his fellow billionaires

Nick sees pitchforks in the future. The Hanauer editorial posted in Politico generated upward of 10,000 comments from 10,000 pitchfork wielders. This plotline—a possible Fourth Turning—is just coming into focus.

Banks and Bankers

“The Bank never ‘goes broke.’ If the Bank runs out of money, the Banker may issue as much more as needed by writing on any ordinary paper.”

~Monopoly board game rule book

Simon Johnson noted that six years after the crisis, the big banks are still only 5% capitalized (20:1 leveraged).ref 212 Twenty-five European banks failed the stress test, which will force them to recapitalize.ref 213 The largest banks were mandated by the Dodd–Frank Bill to “put their affairs together” with formal plans to ensure stability: the Federal Reserve and FDIC rejected all of them—a 100% failure rate.ref 214 JPM has total assets of $2 trillion and a total derivative exposure of $71 trillion.ref 215 Beware of flappy-winged butterflies. If the Fed taps the brakes, those guys are headed right through the windshield. If we hit a bump in the road, it's out through the moonroof.

“The tragedy is not that things are broken. The tragedy is that they are not mended again.”

~Alan Paton, Cry, the Beloved Country

Let's ignore the awkward question of why you recapitalize insolvent banks—you're not supposed to according to Bagehot.ref 216How do you recapitalize them? Best I can tell, banks clean up their risk (a) through a grinding, multiyear balance sheet rehabilitation (a good ground game), (b) by getting their friends at central banks to engineer highly profitable carry trades, or (c) by simply selling their garbage to taxpayers way above market value. The Fed chose the latter two for US banks. They set up “good” banks and “bad” banks. The good banks hold good assets—heads they win—and the bad banks are like state-run Ebola clinics (tails we lose). The banks are also using more traditional methods; they are stepping away from the mortgage market, leaving it to the shadow banking industry. Get ready for good shadow banks and bad shadow banks.

The banks amassed almost $200 billion in fines,ref 217 paradoxically without any convictions of major bankers. (Actually, Iceland just hurled a banker in jail.ref 218 Go Vikings!) There are several nice summaries of JPM's and BofA's illegal activities.ref 219 The tenacious Matt Taibbi describes how the system was corrupted by backdoor dealings to avoid any jail time in The Divide (see Books). Taibbi tells us the no-jail policy was indeed a written policy by Eric Holder and the Obama DOJ. It is said that as you age you tend toward one of two paths: altruism or narcissism. Holder chose the latter. Barry Ritholtz claims that the fines are cleaning up the corporate culture despite the lack of satisfaction.ref 220 I like Barry but wholly disagree: the bill for this legal and moral lapse has yet to arrive.

“The behaviour of the financial sector has not changed fundamentally in a number of dimensions since the crisis . . . some prominent firms have even been mired in scandals that violate the most basic ethical norms.”

~Christine Lagarde, managing director of the IMF

Nothing gets through those beer goggles, Columbo. The details of this year's shenanigans warrant some comment. Credit Suisse admitted to helping wealthy US folks evade taxes but claimed that management was unaware they were running a crime syndicate.ref 221 The Gnomes of Zurich chronically aided and abetted tax evaders. Deutsche Bank and Barclays were in on the scam too.ref 222 (Don't take me too seriously; I understand arguments for the evasion.) We found that JPM was complicit in the Madoff case, and the DOJ knew it.ref 223 (One should assume the same for Worldcom and Enron.) JPM's Asian CEO was brought up on corruption charges because traders cooked the books to conceal losing trades.ref 224 Of course, the whistleblower was denied whistleblower status by the regulators because of the DOJ's zero-tolerance whistleblower policy.ref 225 JPM also helped BNP launder money to sanctioned countries.ref 226 Preet Bharara, Prosecutor of the Stars and head of his own Rainbow Coalition, went after BNP shareholders for almost $10 billion because you never help sanctioned countries. The actual criminals within BNP were left unscathed. JPM paid only $88.3 million to settle similar unlawful dealings with Cuba, Iran, and Sudan.ref 227 Apparently, you get a two-decimal discount if you are domiciled in the United States. Even Bharara has his tolerance limits; he got majorly pissed at Jamie Dimon for giving himself a 74% raise.ref 228 I'm guessing it will make Jamie's huge campaign donation to help Preet crowd source his political career harder to explain. I have a suggestion, Preet: Stop fining shareholders and start jailing criminals. Convict somebody—anybody. Blythe Masters, after narrowly escaping a prison sentenceref 229 (not even close), left JPM and accepted a job as Regulator for a Day at the CFTC.ref 230 That’s how quickly her detractors processed the absurdity and stopped it.ref 231 Blythe will be played by Julianne Moore in the sequel to Catch Me If You Can.

HSBC overstated its assets by what some might call a rounding error ($92 billion),ref 232 which forced it to restrict withdrawals by demanding proof that you need cash (bank run).ref 233 Do grocery receipts count? It also recruited the former head of MI5 (British CIA clone) to join its board, which seems oddly consistent with suggestions that HSBC was laundering money to Hezbollah.ref 234 This also squares nicely with my previous assertionref 2 that HSBC is a retread of the profoundly corrupt and now defunct BCCI. After the next bailout—there will be another—Goldman will underwrite the IPO of HSBCCI.

RBS losses since '08 were shown to top £40 billion since '08,ref 235 an amount oddly comparable to that dumped into it by the taxpayers of one or more countries.ref 236 Fortunately, RBS managed to scrape together executive bonuses totaling 200% of base pay.ref 237 CEO Ross McEwan apologized. All was forgiven. . . . at least forgotten.

Citigroup got hit with a $10 billion tax from the DOJ for its role in the crime spree.ref 238 On a more humorous note, it inadvertently paid out $400 million in fake invoices sent by Banamex (Mexican princes).ref 239 Trolling for payments using fake invoices to huge corporations is a provocative business model.

“Regulators are starting to ask: Is there something rotten in bank culture?”

~New York Times news flash

The punitive qualities of all these fines are often muted by their tax deductibility. And, by the way, where does this $200 billion garnered by the Big Shakedown go? State and federal governments have found a number of worthy causes that are also politically expedientref 240—”a wealth redistribution scheme disguised as a lawsuit.”ref 241 Andrew Cuomo threatened to withdraw BNP's license to operate on Wall Street if they didn't up his vig by $1 billion.ref 242 I can taste vomit in my mouth.

The relief was palpable when MF Global officers and directors were allowed to use insurance money to defend officers and directors rather than give it to creditors.ref 243 A judge ruled that Goldman's shell game, in which they moved aluminum from warehouse to warehouse, was unintentional.ref 244 It was just the tip, your honor! It was just the tip! The actor who played McGruff the crime dog got 20 years for pot and weapons charges,ref 245 the former being legal in some states and the latter a constitutionally protected right. A spoof article describing Holder's departure to JPM was outlandish but so believable that I had to confirm with the source that it was actually satire.ref 246

“When you won, you divided the profits amongst you, and when you lost, you charged it to the [central] bank.”

~Andrew Jackson, former president of the United States

There are a few lawsuits weaving through the courts, and nothing terrifies bankers more than the discovery phase of a trial. Thirteen global banks were sued by Alaska Fund for ISDA fix rigging.ref 247 I'm not sure how you rig a fix or fix a rig or whatever. The nonprofit Better Markets has alleged that the DOJ violated the Constitution (shocking) by acting as the investigator, prosecutor, judge, jury, sentencer, and collector, without any check on its authority or actions.ref 248 A Freedom of Information Act suit showed that the SEC colluded with banks to ensure that they were prosecuted for only a single credit default obligation (CDO) charge and that the rest were covertly included in the settlement.ref 249 Barclays' court battles over Libor rigging could produce some interesting discovery about “fantasy rates.”ref 250 The AIG trial seemed sufficiently consequential as a window into this huge heist that it gets its own section.

The charter of the Export-Import Bank (Ex-Im Bank) is up for congressional renewal.ref 251 Ex-Im bank is, according to Wikipedia, “the official export credit agency of the United States federal government . . . for the purposes of financing and insuring foreign purchases of United States goods for customers unable or unwilling to accept credit risk.”ref 252 It lends money to foreign debtors who cannot get credit through normal channels (credit being so tight and all).ref 253 Who might they be? Well, sovereigns who buy lots of Boeing jets presumably to bomb other countries who also buy lots of Boeing jets.ref 254 Lobbying—quite possibly illegal foreign lobbying—will ensure that the bill is passed. Why not let private banks fund these guys? They've been instigating and then funding foreign wars since antiquity. Congressional opponents risk an airstrike on their next campaign.

Is there any hope that the system will correct itself? In Vietnam, they execute bankers who egregiously screw up by “binding perpetrators to a wooden post, stuffing their mouths with lemons, and calling in a firing squad.” That's making lemonade out of lemons. I suspect that the next crisis may see some punishment meted out extralegally in the US. There appears to be some already.

Zero Hedge was the first to pick up on a rash of dead bankers that stopped short of inspiring a Whack-O-Meter based on the bank Implode-O-Meter from 2009.ref 255 I lost count at about 20 and was shocked to find it is now 36.ref 256 Unfortunately, the guys most likely to make everybody's short lists are not the ones heading off to the ultimate gated community. It's possible that bankers suffer from the Werther effect—the tendency of suicides to come in waves.ref 257 It may simply be the Baader–Meinhof phenomenon,ref 258 or what I’ve always called the “green van effect”—buy a green van and then notice how many are already on the road. Nassim Taleb would likely tell us we are being fooled by randomness: 36 suicides in the large sample size may be normal . . . but I doubt it. Some of the subplots were curious. One was accidentally shot by two guys on a motorcycle. Another, according to the Denver Post, offed himself with eight shots from a pneumatic nail gun.ref 259 It read like satire given that this Final Exit was likely assisted by the Kevorkian brothers. We know there was at least one twisted bastard in the room. One banker went to the light with his whole family, which strikes me as over the top even for a banker. Although JPM’s payroll contained several who met untimely deaths, JPM had taken out $680 billion worth of life insurance policies (curtains default swaps) on their employeesref 260 presumably as a precaution against unfortunate accidents. A Chinese banker both died and fell from a fourth-story window, although the translation is unclear about the order in which the two occurred.ref 261 Even the head of a Bitcoin exchange cashed out.ref 262

“Perhaps sometimes it is easiest if the weakest links, those whose knowledge can implicate the people all the way at the top, quietly commit suicide in the middle of the night.”

~Zerohedge

AIG

Hank Greenberg's lawsuit against the Fed proved the Rosetta Stone of the bailouts. The world was aghast when the Fed bailed out the insurance behemoth to the tune of $187 billion, ostensibly to save AIG but really to save its counterparties (read: Goldman Sachs). The world subsequently blew a collective snot bubble when gazillionaire and former head of AIG, Hank Greenberg, sued the Fed for the bailout.ref 263 Greenberg's suit asserted that the Fed had no right to confiscate 92% of the company without formal proceedings of any kind. Hmmm. It does sound a little sketchy when put that way.ref 264 Well, the lawsuit reached the discovery phase this summer, and the media were all over it:

“The government never sought to couch AIG’s lifeline as a way to push money into the hands of Goldman Sachs, Deutsche Bank, Société Générale and the dozens of other banks around the world. . . . The problem is that so many people don’t like the answers.”

~Andrew Ross Sorkin, Wall Street darling and putative journalist

Not so fast, Andy. Last year I alluded to David Stockman’s assertion that the dominant insurance component of AIG was cordoned off by state insurance statutes—legal tourniquets—from the rotten part of the corpse: the risk of collapse was nil.ref 2 New York's superintendent of insurance (Dinallo) testified as such in the trial.ref 265 Tim Geithner, Hank Paulson, Ben Bernanke, and anyone else intimately involved seemed to have truth issues along with very bad memories. Matt Stoller wrote some great pieces on the AIG case.ref 266,267

“I would be guessing, but I guess I would guess sometime in '08—but I'm not sure.”

~Timothy Geithner under oath, recalling squat about AIG

That is some seriously evasive mumbling. Bernanke was said to have two moods while on the witness stand with David Boies bearing down on him: “annoyed and really annoyed.” Records show he used the pseudonym “Edward Quince” in emails (to Linda Green?) during the crisis,ref 268 presumably to be secret to all except those with a Jekyll Island decoder ring. Key witness and Fed lawyer Scott Alvarez was clear that Paulson had done some serious fibbing to Congress while pushing the TARP (i.e., AIG bailout) through Congress under false pretenses. Alvarez's use of “I don't know” 36 times and “I don't recall” 17 times in one day made for riveting testimony.

Boies: Would you agree as a general proposition that the market generally considers investment-grade debt securities safer than non-investment-grade debt securities?

Alvarez: I don’t know.

Judge Wheeler was smart and easily irritated at Alvarez's bad memory. And unlike Congressional hearings, Boies had all . . . day . . . long.

We heard about the numerous potential suitors wanting to buy up the company as a distressed asset and how Geithner and the gang wanted nothing to do with that: none would pay Goldman back 100 cents on the dollar.

“...Geithner and company shot AIG in the head, and then let other banks feast on its rotting carcass.”

~Matt Stoller, journalist, channeling Matt Taibbi

Will anything come of this? I don't know. Many prominent journalists wrote scathing indictments of those bringing the suit. Some called it laughable, frivolous, ludicrous, absurd. I, however, am rooting for Kappa Beta Phi alum Hank Greenberg. The Fed should not have commandeered AIG the way it did. It should have let the counterparties eat their mistakes rather than carrion. AIG wasn't the only organization that left the reservation. MF Global is suing Price Waterhouse for the bad accounting that led to its demise.ref 269 Maybe somebody will yank Corzine from the Hamptons long enough to take the stand. Watch out for guys on motorcycles, Jon.

The Federal Reserve

“I found myself doing extraordinary things that aren’t in the textbooks. Then the IMF asked the U.S. to please print money. The whole world is now practicing what they have been saying I should not. I decided that God had been on my side and had come to vindicate me.”

~Gideon Gono, governor of the Reserve Bank of Zimbabwe

“We have [made] a colossal muddle. . . having blundered in the control of a delicate machine we do not understand.”

~John Maynard Keynes

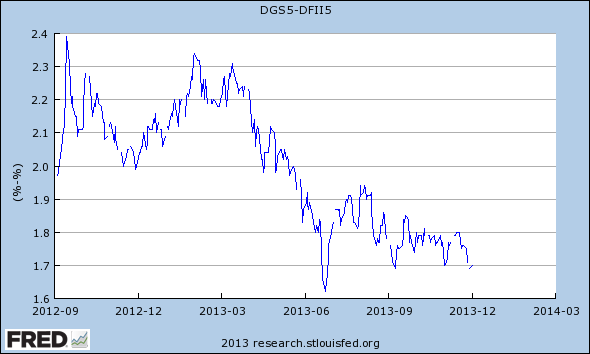

The Fed's dual mandate as both arsonist and firefighter puts it in the untenable situation of relentlessly fighting blazes it lights. It spent most of 2014 trying to convert one zero-interest-rate policy (ZIRP; Figure 13) via the so-called taper to another (ZIRP-lite), the whole time babbling incoherently to maximize its flexibility to use data of its choosing at times of its choosing. Phrases like “macroprudential” and “central tendency outcomes” are all designed to conceal the real purpose behind their sado-monetary policy.

![]()

Figure 13. Graphical view of financial repression.

ZIRP is praised by some as a means of providing cheap funding for public and private debt, allowing equity withdrawal from appreciating assets—kind of like an ATM. Hmmm . . . how'd that work for homeowners? The cost of the Fed's No Banker Left Behind financial repression program is estimated by Bloomberg at more than $1 trillion to the savers (errata: money hoarders). I know I've been repressed. It takes a balance of $480,000 in my checking account for the interest to pay my $4 monthly account fee.

“Savers are figuratively on their hands and knees and rooting around in bushes and between sofa seats for loose change on which to sustain themselves.”

~James Grant, editor of Grant's Interest Rate Observer

The Fed's primary justification for the risk and high cost of their latrogenic ZIRP, however, is to jack up asset markets to all-time highs. Yellen noted that “the channels by which monetary policy works is asset prices . . . I think it is fair to say that our monetary policy has had an effect of boosting asset prices.” Richard Fisher concurred: “We juiced the trading and risk markets so extensively that they became somewhat addicted to our accommodation.”

“We make ?money the old-fashioned way. We print it.”

~Art Rolnick, chief economist for the Minneapolis Fed

Life According to ZIRP seemed pretty good, but $4 trillion is a lotta scratch. A less aggressive approach would have been to monetize it more gradually at, say, $5 million of debt per day, but that would have required starting at the birth of Christ to hit the $4 trillion target. In the midst of the '09 crisis, the Fed needed it fast—Damn the Torpedoes . . . Shock and Awe . . . Surge! Unfortunately, the notion that you cannot print your way to prosperity is gaining traction.

There was a lot of chatter about the Fed scarfing up all the high-quality collateral, causing stress in the repo market.ref 270 Anyone professing to understand the repo market is smarter or more dishonest than I. What I do know is that if the Fed buys up the good stuff—relatively speaking, of course—that leaves only the riskier crap for the rest of the fixed-income buyers, which seems to be the Fed's motive. There's also endless debate about the size and quality of the Fed's balance sheet. Some say it doesn't matter if their balance sheet looks like a yard sale (worthless shit everywhere). The Fed is even talking about an expanded balance sheet in perpetuity. Benn Steil, author of Battle of Bretton Woods and a fellow at the CFR, noted that the Fed must have quality assets in case it ever needs to fight inflation.ref 271 In short, you cannot sop up inflationary liquidity by selling CPDOs and credit default swaps into the market. I am a Benn groupie, but there is no evidence whatsoever that this Fed gives a hoot about inflation.

“But why do I care about some archaic money-market malarkey? Simple. Without collateral to fund repo, there is no repo; without repo, there is no leveraged positioning in financial markets; without leverage and the constant hypothecation there is nothing to maintain the stock market's exuberance.”

~James Bullard, president of the St. Louis Fed, on the role of the repo markets in blowing bubbles

The media got aroused by the Segarra Sex Tapes,ref 272 in which a former regulator-turned-whistleblower recorded more than 40 hours of royal screwing she received trying to uncover nefarious activities at Goldman. At some level, they weren't very salacious in the context of the triple-X performance by the banks and regulators over the years, but this one still left a bad taste. The judge's insensitivity to Segarra's claims weren't so shocking given that Mr. Judge (the judge’s husband) had previously consulted with Goldman.ref 273 All of this occurred under the watchful eyes of the Federal Reserveref 274 but was promptly forgotten until a ProPublica story shoved it back in the public's eye.ref 275 Of course, that was several months ago, and nobody cares now.

The recently released 2008 Fed minutesref 276 offered another window into the crisis. The Fed clearly understood that the banks were rigging the credit markets . . . but so was the Fed. In 2008 Yellen was “worried about the possibility of a credit crunch if higher job losses begin to make lenders pull back credit.” I started writing to folks about it in '02, Dudette, while you guys were making forts out of pillows and blankets.ref 277 Fisher noted, “None of the 30 CEOs to whom I talked, outside of housing, see the economy trending into negative territory.” Bernanke suggested that “one of the lessons is that we [may] need to take the accommodation back.” We're still waiting for that one. Fisher also expressed stress over the “rising cost of hops and barley . . . I am a beer lover.” (The Fed humor was roundly criticized, but that is neuropsychologically sound behavior under stress.) The most contentious part was probably Kevin Warsh declaring, “We are not clueless.” Some would disagree.

I suspect the Fed orchestrates public debate like a comedy improv group. The result is entertaining and, at times, rather garbled. Let's look at some temporally separate quotes that I've reattached with the ol' “. . .” thingie:

“More jobs have now been created in the recovery than were lost in the downturn. . . . Five years after the end of the recession, the labor market has yet to fully recover.”

~Janet Yellen

“The FED needs to be clear; rates will be low for a long time. . . . We need to let the market work.”

~Charles Evans, president of the Chicago Fed

“Inflation expectations are dropping in the U.S., and that is something that a central bank cannot abide. . . . Without leverage and the constant hypothecation there is nothing to maintain the stock market's exuberance. . . . I think you should quit numbering the QEs.”

~James Bullard, president of the St. Louis Fed

The Fed's second tactic was to feign concern that moral hazard (over-reliance on backstops) had fostered too many animal spirits. Are you kidding me? The Fed is admonishing us for going out on the risk curve? Now whose fault is that? As Mark Gilbert of Bloomberg noted, “It's an odd world indeed where the major central banks have all adopted the mantra of 'lower for longer' on interest rates, and are now berating the financial community for listening.” Some compare QE to alcoholism, but that is not really valid: One is a terrible addiction with devastating withdrawal symptoms, the other is merely a drinking problem.

“There is some evidence of reach for yield behavior.”

~Janet Yellen, June 18, 2014

I think they dropped Janet on her head when they were competing to see who could throw the Fed chair the furthest. (Hey. Back off! At least I laid off the “flat head” joke. That would have been tasteless.)

As Caligula once said, every orgy must end and always with a bang. It seemed to be time. The Fed began to foam the runway for a decrease in QE, even possibly raising Fed funds rates (albeit much later than any rational person could imagine.) The Fed seemed to believe that if it hiked rates with ample warning—if it pulled the trigger really, really, really slowly—it wouldn't blow the global economy's head off. The Fed began the Green Mile toward the dreaded taper. As described and critiqued in the section on bonds (see above), not much happened. It began coercing credit-addicted investors into rehab, but the stay at the Betty Ford Clinic was short-lived. In the fall, a 10% drop in equity markets spread fear in the Fed—OMG!—prompting Bullard to declare, “We could go on pause . . . and wait until we see how the data shakes out.” An ensuing immaculate rally was dubbed the Bullard Rally (Fed cat bounce). Damn, another dud.

Careful Red. The Fed may have kept rates too low for too long (again), causing serious malinvestment (again). Loose credit has kept the losers in the game (again), causing the economy to rot (some more). The Fed suffers acute Hayekian Fatal Conceit—the belief that a committee of a dozen mid-level bureaucrats of moderate intelligence can control something as unimaginably complex as the global economy better than Darwinian selection and the Wisdom of Crowds (free markets). If the Soviets were still around—they went broke trying to control markets—I think they would agree. Let's listen to the voices of just a few more detractors with serious gravitas before moving on:

“The number of times that the Federal Reserve has hiked interest rates without a negative economic or market impact has been exactly zero.”

~Lance Roberts, STA Wealth Management

“This time is different . . . because the Federal Reserve’s zero-interest rate policy has starved investors of all sources of safe return, forcing them to accept risk at increasingly higher prices and progressively dismal long-term prospective returns.”

~John Hussman

“There is agreement in the Fed that QE is about the worst thing you can do. . . . These guys are painting themselves into a corner . . . with great, great negative possibilities. . . . The Fed wants to get out of the QE business because it has brought no success and a great deal of criticism.”

~Art Cashin

“I don't really like the Fed very much . . . I wish the Fed were not manipulating the market the way it is.”

~Jeffrey E. Gundlach, Doubleline Capital

“A key flaw in US policy is the Fed's linear thinking—believing that the shock therapy of QE could not only save the patient in the depths of crisis but also foster sustained recovery.”

~Stephen Roach, Yale University and former Morgan Stanley chief economist

“[Yellen] won’t raise rates to fight incipient bubbles. For all of our sakes, we really wish she would.”

~Seth Klarman, Baupost Group

“Where does their confidence come from?”

~Stan Druckenmiller, legendary hedge fund manager, on central bankers

“No one has ever seen anything like this . . . if you look at the details of what these central banks are doing, it’s all very experimental. . . . There is something fundamentally wrong.”

~William White, former chief economist of the Bank for International Settlements

“You will see a system primed for a rerun of 2008, perhaps even faster and more intense this time.”

~Paul Singer, Elliot Management

“We don’t understand fully how large-scale asset purchase programs work to ease financial market conditions.”

~Bill Dudley, president of the New York Fed

Baptists

“Sell everything and run for your lives.”

~Albert Edwards, Société Générale

Every year I include collections of comments that seem prescient (Baptists) or off-kilter (Bootleggers)—always in their own voices (quotes) and often suffering well-reasoned paranoia. This year I even have a couple who switched teams or showed bi-curiosity. I begin with the Baptists.

“We’re in a world where there are very few unambiguously cheap assets.”

~Russ Koesterich, chief investment strategist at BlackRock

In all likelihood, this manipulation will fail as every attempt at price manipulation since Diocletian’s Edict on Maximum Prices in the 3rd century. The only outstanding question is one of timing.”

~Louis-Vincent Gave, CIO of Gavekal

“Living in a largely peaceful world with 2% GDP growth has some big advantages that you don’t get with 4% growth and many more war deaths.”

~Tyler Cowen after discussing the stimulative effect of war

“The stock market does not reflect what's going on in the economy. . . . Holding cash is a better than investing in an over-valued stock market.”

~Sam Zell, largest real estate tycoon in the universe

“On almost any metric the US equity market is historically quite expensive. . . . Can we say when it will end? No. Can we say that it will end? Yes. And when it ends and the trend reverses, here is what we can say for sure. Few will be ready. Few will be prepared.”

~Seth Klarman, Baupost Group

“Collapses of even advanced civilizations have occurred many times in the past five thousand years, and they were frequently followed by centuries of population and cultural decline and economic regression.”

~NASA scientists channeling Joseph Tainter

“Our tinkering artificially short-circuits the fundamental capacity of the system to allocate its limited resources, correct its errors, and find its own balance through the internal communication of information that no forestry manager could ever possibly possess . . . homeostasis ultimately wins through a raging inferno.”

~Mark Spitznagel, Founder Universa Investments

“It takes character to sit there with all that cash and do nothing. I didn't get to where I am today by going after mediocre opportunities.”

~Charlie T. Munger, Berkshire Hathaway

“You’re screwed and even though they say it’s in your best interest because zero rates and money printing will help the economy, don’t believe them anymore because the strategy has failed.”

~Peter Boockvar in an open letter to savers

“This market intervention and manipulation has fostered the greatest-ever speculation in global securities markets, which has motivated only greater central control . . . central bankers believe that they have no choice but to dominate markets—to dominate seemingly everything.”

~Doug Noland, Federated Investors

“There's no argument—you have to worry about the excessive printing of money!”

~George Soros, Soros Fund Management

“Today’s levels of interest rates and stock prices offer a historically unacceptable level of risk relative to return unless the policy rate is kept low—now and in the future.”

~Bill Gross, manger at Janus and founder of Pimco

“What we have never had before, at least in my reading of financial history, is governmentally sponsored bull markets superimposed on a structure of low interest rates.”

~James Grant

“Advanced economies with financial markets at risk for runs and fire sales may need to put in place mechanisms to unwind funds should they come under substantial pressure that threatens wider financial stability.”

~IMF

“...when it changes it does so quickly, and the impossible becomes the inevitable without ever having been probable.”

~Bill Fleckenstein, Fleckenstein Capital

“Paul [Krugman] will continue to be mostly wrong, mostly dishonest about it, incredibly rude, and in a crass class by himself.”

~Cliff Asness, founder of AQR Capital

“QE hasn’t been a success in the demand side because the [banks] just let it sit. . . . When that starts, all things can happen, and not all of them are good.”

~Alan Greenspan (post-baptism)

Bootleggers

“I barely made it from the desk to the bed, where I lay curled up in a hallucinatory state for the next eight hours. I was thirsty but couldn’t move to get water. Or even turn off the lights. I was panting and paranoid, sure that when the room-service waiter knocked and I didn’t answer, he’d call the police and have me arrested for being unable to handle my candy.”

~Timothy Geithner, former head of the New York Federal Reserve, after consuming pot during the financial crisis

“I'm going to test your numerology skills by asking you to think about the magic seven. Most of you will know that seven is quite a number in all sorts of themes, religions. If we think about 2014—alright I'm just giving you 2014—you drop the zero, fourteen . . . two times seven!”

~Christine Lagarde, former head of the IMF, unaltered by pot

The bootleggers are an eclectic mix. Some are reasonable souls saying what I think are unreasonable things. Others seem less benign, espousing stunted and vapid ideas. They share the common trait that what they say seems so unmemorable, yet I'm driven to archive it. The bootleggers are, unlike Geithner and Lagarde, more than capable of expressing what is going on in their skulls. Last year I gave Krugman his own section, so I went light this year.

“This is when you’re supposed to think about preserving some of your money. I am nervous. I think it’s nervous time [5/15/14] . . . all of those things [that made me nervous] alleviated, one by one [6/1/14].”

~David Tepper, May 15, 2014

“When the Austrian brain-worm invades, you start believing things like: (1) Federal Reserve money-printing is a government plot to boost big banks, (2) prices are rising much faster than anyone thinks, (3) real ‘inflation’ means money-printing, not an increase in prices, (4) printing money can never boost the economy, (5) academic economics is a plot to use mathematical mumbo-jumbo to cover up government giveaways to big banks, etc., etc.”

~Noah Smith on Austrian economicsref 278

“Noah Smith should really be getting out his papers instead of blogging. I think my career choice would be for him to publish.”

~Paul Krugman

“But insiders also understand one unbreakable rule: they don’t criticize other insiders.”

~Larry Summers, former president of Harvard and former secretary of the Treasury, to Elizabeth Warren

“Future profitability is better than what we were expecting.”

~Analysts at Citigroup in the Crystal Ball Division

“The cyclically adjusted P/E ratio suggests S&P 500 is now 30%–45% overvalued compared with the average since 1928 . . . we lift our year-end 2014 S&P 500 price target to 2050 (from 1900) and 12-month target to 2075.”

~David Kostin, Goldman Sachs

Europe

“I say to all those who bet against Greece and against Europe: You lost and Greece won. You lost and Europe won.”

~Jean-Claude Juncker

“I (and others I talk to) are having an ever-harder time seeing how this ends—or rather, how it ends non-catastrophically.”

~Paul Krugman, that Paul Krugman, on Europe

I submitted last year that Cyprus—a clunky beta test for bank “bail-ins”—would “eventually become part of a huge story,” and I stand by that. The bail-ins involve shareholders and creditors—creditors including depositors (aka you)—bailing out banks instead of taxpayers (aka you). Not to worry, Yanks. This is a European story. (Just kidding; it's global.) You should read GoldCore's superior discussion of the bank bail-in,ref 279 which is a euphemism for good ole-fashioned bank failure (but without the lines at teller windows). Don't have time to read it? Hooey. You’ve obviously run out of valid reading materials. The message is clear: choose your bank carefully, diversify by institution, keep balances low, choose carefully the sovereigns in which your banks are domiciled, and quite possibly put your head between your knees. Some are predicting a pan-European bail-in.ref 280 Germany proposes a wealth tax on southern Europe—Club Med countries.ref 281 It has been suggested that “the savings of the European Union's 500 million citizens could be used to fund long-term investments to boost the economy and help plug the gap left by banks since the financial crisis.”

On the confiscation front this year, the Austrians passed legislation for a bail-in of Hypo Alpe Adria bank that does not exempt the first 100K euros on deposit.ref 282 In short, they whacked the proletariat, prompting one bank analyst to call it “a really stupid idea.” It was also a retrospective bail-in involving events before the legislative acts—a claw back—suggesting that expropriations were coming. Spain imposed a “state tax on bank deposits.” The accounts were said to be sacred—wrong religion I guess. Catalonia voted overwhelmingly to secede from Spain.ref 283 I can't imagine why (and all I hear are spanish crickets.) Confiscations took on a new-era flair with a negative interest rate policy. In this world you pay to keep your money in those pillars of stability, the European banks, which were said to be way under-capitalized owing to $800 billionref 284 to $2 trillionref 285 of unwritten-down bad debt. I have mixed emotions on whether slow recapitalization is good or bad because of the wealth transfers associated with flash recapitalizations (see Banks).

As though on queue, twenty-five European banks failed the highly handicapped stress tests, prompting immediate questioning of the veracity of the tests.ref 286 (I suspect they are worthless.) Bulgaria had to seize one of its biggest banks to “avoid” a bankruptcy (whatever that means).ref 287 Austria's Erste Bank took a 40% write-down because of legislation in Hungary forcing transparency.ref 288 Portuguese Banco Espirito Santo hit the rocks and was forced to use its own finance arm to lend itself money—liquefying by drinking its own urine.ref 289 Other attempts to save it included banning short sellers. Always blame the short sellers. Of course, the shares eventually found their equilibrium price of zero—Banco Espiece O' Shito. Saxo Bank's Peter Garnry says the “event has hit European financials like a torpedo and has revived investors’ darkest nightmares about Europe.” During a garbage strike, the fun-loving Portuguese left their garbage at banks.

On the economic front, Europe is a basket case. They talk about austerity like it's some bad thing, like the ice bucket challenge. Austerity is an effect not a cause, and it is transitory only if you get on it early. Austerity can't wake a cadaver. Germany looks to be OK because it's vendor financing Club Med to buy German goods. In the 17th century, Europe vendor-financed Spain as Spain ran out of New World gold. That didn't work either. For every 100 residents of Belgium, 28 are working in the private sector.ref 290 European unemployment is soaring, especially among youth (who are notorious for not being that emotionally resilient.)ref 291 Household debt in England is 170% of disposable income, while the Great Danes are at 265%.ref 292 Italy is insolvent to the point of not paying suppliers,ref 293 and Greece's 2,000-year lost decade continues unabated.ref 294

While the Euromess was playing out, equities soared and the bond yields plumbed century lows (see The Bond Caldera) owing to the subversion of price discovery by Mario “Whatever It Takes” Draghi and European central bankers. Meanwhile, those charged with pumping asset prices to maintain world peace continued to chastise investors for chasing risk:

“Asset values [are] at their highest ever . . . at the other end, we see a real economy where recovery is not really strong . . . that discrepancy between the two is quite worrying.”

~Christine Lagarde, head of the IMF

When credit spreads began to widen and price discovery loomed, the unholy trinity—the so-called Troika (EC, IMF, and ECB)—began passing pickles. The G20 announced it wanted $2 trillion in increased economic activity (and a pony). But as one Bloomberg reporter noted by email, “There's a real sense of revenge running thru Europe's apparatchiks presently. Not helpful.” The Hessians were stirring:

“The ECB has reached the limit in helping the Euro Area.”

~Wolfgang Schäuble, German minister of finance

Enter Mario Draghi with guns blazing, locking and loading a weaponized printing press, to create hundred of billions of euros designed to blow up on impact. In a sneak attack, Draghi dragged Europe into the global currency wars.ref 295 For those hoping to invest in the Europe's future at fair prices, Mario's coin in the fuse box was a donkey punch.

“The fundamental problems are not solved and everybody knows it . . . the euro crisis is not over.”

~Maximilian Zimmerer, CIO of Allianz SE

In other news, Europe is also hanging on the precipice of global energy shortages if Russia decides to play the energy card—and looking at something even worse if Russia pulls the military card. Venice voted to secede from Italy by refusing to send taxes to Rome.ref 296 Spanish planes illegally challenged a British airliner in a fight over . . . fish.ref 297 The UK is close to full energy dependence as North Sea oil falters.ref 298 It seems likely to me that energy dependence eventually leads to debt crises. Scotland voted not to secede from Great Britain (or England or whatever). But as Stalin wryly noted, “People who cast the votes decide nothing. The people who count the votes decide everything.” A few hanging chads maybe? And if all that weren’t enough, somebody leaked embarrassing nude photos of a young Angela Merkel.ref 299

In a world of perfectly efficient stock, bond, and housing markets, investors seem to be yelling, “Hey Guys: it's a dud!”

“It isn't our job to go out hunting for rigging of markets.”

~Governor Mark Carney, Bank of England

“People usually get angry when they are afraid, and Mario looked furious yesterday.”

~Mark Gilbert, Bloomberg, email

Asia

“Asia is in a holding pattern with troubles in the queue waiting to make headlines.”

~David B. Collum, 2013 Year in Review

Once I figured out which countries are actually parts of Asia, I was feeling prophetic. We've got pro-democracy riots in Hong Kong and martial law in Thailand. The action, however, was in China, Japan, Russia, and the Middle East. We have some seriously existential risk brewing in these regions, so let's reverse-crack our knuckles and get into it before somebody releases the launch codes.

China

China is starting to crash

Building ghost-cities was rash

So now they must pay

For debt gone astray

The assets they built are now trash

~@TheLimerickKing

As economic tensions mount, so do political tensions. The big issue looks to be a battle royale brewing between the US and China. China warned the US against a “Crimea-style land grab,” although I'm not sure what that would entail.ref 300 Our DOJ has accused China of cyberspying.ref 301 Shocking.

The real clashes will be economic and monetary. The early battles are fought using bilateral trade agreements. China is setting up direct deals that explicitly exclude the US dollar. They have signed bilateral trade agreements with the UK;ref 301 currency swaps with Switzerland,ref 303 Singapore,ref 304 and Canada;ref 305 direct trade of energy for yen with Gazprom and Qatar;ref 306 and yuan-clearing banks in Luxembourg and Paris.ref 307 All of these arrangements chip away at dollar hegemony, although I wouldn't call them causal; a dollar demise finds its roots in US policy. Triffin's dilemma says that a reserve currency fails owing to a ballooning trade deficit.

One could be forgiven thinking that the Chinese variant of state capitalism somehow makes the country less sensitive to credit busts. However, the housing market is said to have 50 million unoccupied houses and 70 million unoccupied apartments.ref 308 Maybe building unoccupied “ghost cities” equivalent to 50 Manhattans between 2008 and 2012 is OK.ref 309

Alas, China is vulnerable to the vicissitudes of the credit markets just like everybody else. The bust has begun, and with debt estimated at 250% of GDP, this landing will be tough to stick.ref 310 The banks are beginning to falter. Famed short seller and China bear Jim Chanos notes that “the Chinese banking system is built on quicksand.” Lack of deposit insurance adds a special flare to bank runs. Gazillions of yuan in loans have turned out to be backed by relentlessly rehypothecated physical collateral (industrial metals).ref 311 These guys really are fast learners. Loan guarantors appear to be totally insolvent.ref 312 Companies are finding that payments from their counterparties are taking longer to arrive,ref 313 prompting one businessman to note: “If you don't pay me and I pay others, aren't I just a sucker? I'm not that stupid.” Counterparty risk is a bitch, ain't it?

Of course, these nouveau capitalists with Western PhDs have discovered the miraculous cures available from bailouts. China Development Bank lent 2 billion yuan to coal company Shanxi Liansheng.ref 314 The People's Bank of China cut rates to 5.6% on November 21.ref 315 China displays a notable difference in its response to bank crises, however, compared with that of the Western world: they hang bankers.ref 316 There is a second difference: their one-child policy has left them with millions of single—presumably sex-crazed—young men that can be recruited by General Tsao for when the Szechuan hits the fan. This plot is just beginning to thicken.

“While we believe Chinese banks’ credit woes will unfold gradually, the disturbing thing is that the end is nowhere in sight.”

~Liao Qiang, Beijing-based director at Standard & Poor’s.

Japan

“I've never really wanted to go to Japan, simply because I don't like eating fish, and I know that's very popular out there in Africa.”

~Britney Spears

Fukushima continues to smolder. Be wary of the news reports, however. Becquerels are tiny units so the radiation leakage is easy to state hyperbolically, and reports of cancer clusters are notoriously dubious, as outlined in The Drunkard's Walk (see Books). Meanwhile, Japan's economy is about to go critical, as summarized masterfully by Grant Williams.ref 317 In short, their sovereign debt has soared, the personal savings rate is plumbing post-war lows, the current account balance has tanked in the face of unstimulating Abenomics (monetary camel toe), and the population will continue to age for decades.

The basic premise of Abenomics—the seemingly cockeyed Keynesian construct that has failed for 25 years now (always because it was not enough)—seems to be based on the idea that one can bid up the price of assets and declare enhanced wealth regardless of per-capita output. It didn't work during the pre-bust '80s. It didn't work during the subsequent 25 years. It seems unlikely to work now. Almost 50% of Japan's tax revenues go to paying debt service at interest rates that are at record lows. Rising rates would crush them; monetization will continue. Kuroda's latest announced QE was shocking in its magnitude, timing, and dubious support (ministers voted 5 to 4). The market went on a 'roid rage, but that won't last. The yen was crushed so much and so fast that it spooked the BOJ into jawboning the decay rate.

“There are no limits to our policy tools . . . to completely overcome the chronic disease of deflation, you need to take all your medicine. Half-baked medical treatment will only worsen the symptoms.”

~Haruhiko Kuroda, governor of the BOJ on QE

A little odd that Kuroda thinks that is how you “take all your medicine.” Japan’s Bugger Thy Neighbor monetary policy—a currency war—includes seriously dubious interventions into the equity market. The BOJ is now going to pile monetized Japanese equities on top of Japanese pensions loaded with horrifically dubious Japanese debt. The serpent is eating its tail. Abe is working on a plan to give everybody gift cards to spur spending (no joke).ref 318

The justification for Japan's monetary policy is that Japan is said to be in the throes of a deflation despite a steadily growing money supplyref 319 and rising prices of goods and services.ref 320 Japan is in a depression—a very long one. Depressions are simply serial recessions, the latest starting in October. The pessimists say that it is already game over; demographics and foolhardy malinvestment are so deep-seated that a catharsis is in the future. Kyle Bass is still predicting a bloodbath, a “transformative” moment.ref 321

“Kuroda knows when to go all in. The BOJ is basically declaring that Japan will need to fix its long-term problems by 2018, or risk becoming a failed nation.”

Takuji Okubo, chief economist at Japan Macro Advisors

Speculation that the Japanese have developed a process to convert sewage into foodref 322 sounded “transformative”, but the suspicion that sewage has been depleted of nutrients is correct; the technology is Internet legend. What a shame. I was really looking forward to a Sewage BurgerTM and some SewshiTM.

ISIS

“If a jayvee team puts on Lakers uniforms that doesn’t make them Kobe Bryant.”

~Barack Obama on ISIS

“They are as sophisticated and well-funded as any group that we have seen. They're beyond just a terrorist group . . . an imminent threat to every interest we have.”

~Robert Gates, former Director of Central Intelligence, on ISIS

“ISIS is not Islamic.”

~Barack Obama imitating George W. Bush

This plotline goes disturbingly far back. Eleventh- and 12th-century crusaders went looking for salvation and found little. Twentieth-century imperialists went looking for oil and hit the jackpot. But what an incredible mess. Frontline offered an excellent overview;ref 323 the explanation in Figure 14 is even better.

![]()

Figure 14. Concise explanation of US Middle East policy.

“That child should be playing with other kids, not holding a severed head.”

~Senator John Kerry, master of the obvious

There were some extraordinary moments during this Clash of Civilizations (Miracle on ISIS). In a Middle East version of a wilding, the reconstituted Iraqi army ripped through serious desert real estate, replacing their Black and Decker drills with guns, ammo, troops, Apache helicopters, stinger missiles, 88 pounds of uranium, and $400 million in beer money. (Goldman was planning an IPO for some serious petrodollar-denominated fees; they even had the Nasdaq symbol picked out.) As night follows day, genitals got mutilated, and heads began to roll. Stratfor's George Friedman warned us in America's Secret War not to underestimate any of the players in these global chess matches. Gladwell further reminds us in David and Goliath (see Books) that the obvious underdogs often win these fights.

“Once you got to Iraq and took it over, took down Saddam Hussein’s government, then what are you going to put in its place? That’s a very volatile part of the world, and if you take down the central government of Iraq, you could very easily end up seeing pieces of Iraq fly off: part of it, the Syrians would like to have to the west, part of it—eastern Iraq—the Iranians would like to claim; they fought over it for eight years. In the north you’ve got the Kurds, and if the Kurds spin loose and join with the Kurds in Turkey, then you threaten the territorial integrity of Turkey.”

~Dick Cheney, 1994

It's always fun until someone loses an eye! That happened when ISIS began slobbering over the Saudi oil fields and, presumably, the whole Saudi regime.ref 324 The United States had to start building a case to attack. The humanitarian mission is always a strong opening play: do it for the children (the ones who are left). Soon an enemy laptop was discovered with plans by ISIS to use bio-weapons. Sure. I believe that. Must have been found by the informant named Q-Ball. (Oops. Wrong war.) We began discovering old—very old—chemical weapons dumps posing risks akin to those at Love Canal and started pushing that angle again. Fox News kept claiming that ISIS was amassing troops on the Mexican border, apparently in alliance with drug lords, illegal aliens, democratic voters, and Ebola carriers, for the final battle in Lord of the Rings. Shockingly, the Republicans wanted to build a big fence. The Turks got caught on tape planning a false-flag attack, but they were still smarting from the Erdogan tapes revealing the previous botched variant.ref 325,326

The US administration faced a quandary. Bombing ISIS strongholds would inadvertently give Syria an advantage. The solution? Bomb them both just to be fair.ref 327 Who thinks up this stuff? The administration finally settled on the general strategy of arming everybody, hoping that everybody would get killed. God or some other deity can sort them out. Estimates of 10:1 civilian-to-militant kill ratiosref 328 have been reported for US drone attacks. The United States put together a massive coalition that included the Bloods and Crips, Klingons, and Girl Scout Troop 539 and began Operation Iraq Liberation (OIL).

Meanwhile, ISIS seems to be positioning to reestablish Syria—the old Syria with seriously expanded borders. Was this all a black swan event? Listen to this interview of Wesley Clark from 2007 in which he says half a dozen countries would be taken out over the next five years.ref 329 One Nobel Prize and seven bombed Muslim countries later, one begins to wonder.ref 330

“Note to Self: Next time, no Middle East.”

~@TheTweetofGod

Russia

“After the Russian army invaded the nation of Georgia, Senator Obama's reaction was one of indecision and moral equivalence, the kind of response that would only encourage Russia's Putin to invade Ukraine next.”

~Sarah Palin, 2008

“I can see Alaska from my front porch.”

~Vladimir Putin

OK. I made that last one up, but it's official: Cold War 2.0 has started. Putin is a popular guy in Russia. He’s sporting an 83% approval rating (almost as high as Obama's.) The Russians are tired of being famous for dash-cam videos on YouTube. The year started innocuously enough with the $50 billion Sochi Olympic fails live-tweeted by unhappy reporters:

“My hotel has no water. If restored, the front desk says, 'do not use on your face because it contains something very dangerous.’”

There was a lot of cackling when the Olympic logo failed. Putin's agitation watching the Olympics, wrongly attributed to a punk performance by his commie-dog athletes, was because he was anxious for the real games to begin.

The brawl started almost immediately after the closing ceremonies. We had already toppled Ukraine's democratically elected leadership to install a more Western-pliable variant.ref 331 The mistake we made has been described in an incisive article by John Mearsheimer in Foreign Affairs:ref 332 we wanted the Ukraine and Crimea to satisfy our whims. Russia had to have the Ukraine to satisfy its needs.

“Obama, however, has only tenuous control over the policymakers in his administration—who, sadly, lack much sense of history, know little of war, and substitute anti-Russian invective for a policy.”

~Letter to Angela Merkel from US intelligence wonks

Who could have guessed what would happen next? While we blathered on about the whereabouts of Malaysia Airlines Flight 370, Russian-speaking troops dressed as Maytag repairmen filled the power vacuum in Crimea. The missing flight had more oddities than a state fair midway.ref 333,334,335 Nobody wants to admit that a missing flight makes for a much more prolonged distraction than a downed flight. That would make you a conspiracy theorist.

Obama and Putin immediately started trading tits for tats. Obama teed off with Harvardian rhetoric. Putin responded using air jerks with full eyeball rolls. Intimidating a guy who rides horses, sharks, and grizzlies shirtless was not easy. We began pressuring Mother Russia with sanctions.

“Negotiating with Obama is like playing chess with a pigeon. The pigeon knocks over all the pieces, shits on the board, and then struts around like it won the game.”

~Vladimir Putin

“I sometimes get the feeling that somewhere across that huge puddle, in America, people sit in a lab and conduct experiments, as if with rats, without actually understanding the consequences of what they are doing.”

~Vladimir Putin

The European allies cooperated reluctantly. Germany was remarkably cozy with Russia for a while, although the Putin–Merkel romance went frigid when we threatened to strap on some sanctions against Deutsche Bank.ref 336 We grabbed up another Cypriot bank supposedly containing Russian oligarch money,ref 337 forgetting that we stole every euro from them last year. The Polish foreign minister expressed angst over the fact that “we gave the Americans a blow job” and then called us “losers. Complete losers.”ref 338 Apparently, he took one on the chin at some point. (Sorry. Gratuitous sex joke.) It got a little embarrassing and diplomatically tricky when a top US State Department diplomat told the US ambassador to Ukraine that we should “Fuck the EU,” which led to a “sorry—my bad” apology.ref 339 The Ukraine banned exports of military hardware to Russia as Russia was importing Ukraine.

“What we've done over the past 10 years is to create a new method of projecting U.S. power . . . a growing arsenal of financial weaponry aimed at hitting foreign adversaries.”

~David Cohen, undersecretary for terrorism and financial intelligence, US Treasury

Soon the Europeans agreed to ban the buying of Russian bonds.ref 340 Quite the sacrifice. Standard and Poor’s downgraded Russian debt by a notch.ref 341 The Moscow stock exchange seized up.ref 342 Visa and MasterCard suspended service.ref 343 One Russian oligarch noted that the new Chinese credit card was attractive because “at least the Americans can't reach it.” JPM, spotting opportunity, blocked money transfers of Russian money back to Russia without authorization by the administration.ref 344 Really? They kept somebody's money? This is my shocked face: :<O. (In All the Presidents Bankers, Nomi Prins describes how the banks prolonged Carter's Iran hostage crisis by doing the same thing.) The international court at The Hague fined Russia for a decade-old whompin' of oil giant Yukos,ref 345 prompting a somewhat eerie response:

“There is a war coming in Europe. Do you really think this matters?”

~Putin confidant on The Hague verdict

Unsurprisingly, Russian energy giants were handled with kid gloves by the Europeans in this Game of Thrones. Winter was coming. China and Russia began setting up a pile of bilateral trade deals including a 30-year, $400 billion energy agreement.ref 346 I use dollars only for the reader's convenience 'cause it certainly ain't gonna be denominated in dollars. All the while we scratch our heads over the interests of Joe Biden's son in Crimean gas companies.ref 347

“Any fourth-grade history student knows socialism has failed in every country, at every time in history.”

~Vladimir Putin

The US grabbed control of the global energy market to put the serious hurt on Putin. The Saudis started talking about how they were comfortable with oil below $80 per barrel.ref 348 Some claimed it was to push the marginal frackers in the US out of the game,ref 349 but it's not obvious why they would bother since prices were rising at the time. More likely, the Saudis did it as part of a US-engineered collapse of the oil price.ref 350 We got to inflict discomfort on Putin, and in return, the Saudis got military support against ISIS fighters heading for their oil fields.ref 351 Our primal urge to fight Putin, however, nuked the US energy industry, the junk bond market, and possibly a few sovereign states (see Energy). The consequences of this will be clearer next December.

Cold War 2.0 was looking a little dicey militarily too. Another Malaysia Airlines flight bought the collective farm. (That pun's just plane wrong!) The Swedes undertook a massive search for a rogue Russian sub (Red October).ref 352 Russian fighters have been buzzing the coast of California.ref 353 One is rumored to have passed over a US destroyer a dozen times and, if you believe it, jammed the ship's radar and detection systems.ref 354 Russians, we are told, hacked the White House and a bunch of megabanks.ref 355,356 Russia's bilateral trade arrangements all appear targeted toward dethroning the dollar. The so-called petrodollar is at risk. I wouldn't underestimate the probability and consequences of an eventual dollar demise. For now, however, it is the ruble and the rubes who have leveraged long positions in it running laps around the drain.

The idea of pressuring Russia with the vicissitudes in the marketplace strikes me as silly. I've watched the dash-cams; those guys are tough. Russians survived cannibalism in the Siege of Leningrad (1941–44). Our idea of suffering is camping out overnight at Target for iPhones, which are for some reason perceived to be in life-altering short supply. The investor lobe in my brain tells me to get ready for a geopolitically induced buying opportunity in the energy sector. My dark-horse economic winner of the 21st century—admittedly a long time—is Russia. Oddly enough, all this may be Kabuki theater (a dud). Catch this exchange between Obama and Medvedev, who were unaware of the directional microphone.ref 357

Obama: This is my last election. After my election I have more flexibility.

Medvedev: I understand. I will transmit this information to Vladimir.

Ebola

“This is not an African disease. This is a virus that is a threat to all humanity.”

~Gayle Smith, senior director at the National Security Council

“Ebola was unreal and a gimmick aimed at carrying out cannibalistic rituals.”

~Former Nigerian nurse

Years ago I read The Hot Zone and Demon in the Freezer, but it was The Great Influenza, the story of the 1918 flu pandemic costing 100 million lives, that piqued my interest in Ebola. It turns out Ebola and the flu have a common feature: the body's immune response in the form of a “cytokine storm” poses great risk.ref 361 With numbers still in the hundreds but evidence that Ebola had entered African cities, I did a back-of-the-envelope calculation of a three-week doubling time. Bingo! Ten thousand cases later, it proved spot on. Ebola was undeniably existential risk of an unknown probability. Vice President Biden thought we should send troops to fight Ebola until he found out it wasn't a country. It wreaked havoc on West Africa, where annual per-capita healthcare expenses measure in double digits. Gunmen looting Ebola clinics, families defying government orders and simply dragging bodies to the street, and the generalized breakdown of the healthcare systems in affected countries painted a horrific picture of human suffering.ref 362

Ebola was considered a distant problem to many sitting cloistered in the protective warmth of Obamacare. It finally caught the collective attention, however, when it found its way to Dallas and then spread just a little bit.ref 363 I can't say I panicked, but I understood the concern. Speculation that it might be transmitted sexually—of course it is—gave way to the realization that Ebola lasts 90 days in semen.ref 364 This prompted authorities to urge users to stop turning their condoms inside out and reusing them. How about just throttling some poultry for a couple of months? The fear that bushmeat was infectious sent shudders through the high command of Taco Bell. Obama, although slow to react overtly to avoid panic, appointed a large campaign donor, lawyer Ron Klain, to be his Ebola czar,ref 365 prompting Bill Bennett to note, “I was a czar. This ain't no czar.” For a country professing allegiance to democracy, we sure appoint a lot of Czars. In any case, Czar Ron went into exhile the day he was appointed.

The more sanguine began comparing the total number of Ebola cases to Derek Jeter's strikeouts and Oscar Pistorius's ex-girl friends. Countless declarations that “more people have died from [fill in the blank] than from Ebola” made me yearn for a swift demise. The glib intellectuals were crystal clear: only peasants worry about such silly things as a 60% fatality rate on an exponentially growing pool of patients. An excellent lecture by Berkeley physics professor Albert Bartlett on our collective ignorance about exponential functionsref 366 might prove enlightening for the editorial staff of the New Yorker:

“Study: Fear of Ebola Highest Among People Who Did Not Pay Attention During Math and Science Classes”

~New Yorker headline

It has been a dud so far (except in West Africa). There were some odd moments like this 1971 Holiday Inn ad featuring Ebola.ref 367 A chap named Clipboard Idiot—armed with only a clipboard to protect himself from an infected patient—underscored the risks of inadequate response.ref 368 As the disease may be heading into quiescence, however, I remind the reader that glib dismissals of existential risk will, on very rare occasions, prove fatal.

“Bring out your dead.”

~Monty Python

Government

“It is terrible to contemplate how few politicians are hanged.”

~Gilbert Keith Chesterton (1874–1936), British writer

“Our own government did more harm to the liberties of the American people than bin Laden did.”

~Ron Paul

Anarcho-libertarians decry the need for any government, ignoring the fact that all civilizations since the dawn of civilization have voted yes. Government appears to be a necessary evil, but evil it certainly is sometimes. This is a place where “bipartisan” means some larger-than-usual deception is being carried out. This is an organization that is still compensating Irene Triplett, a very elderly lady, for her father's military service . . . in the Civil War.ref 369 Let's take a quick peek at why confidence in Congress has dropped to an astounding 7% (astounding that it's not 0%).

The capital of crony capitalism, of course, is Washington DC. The geniuses in Congress pushed the Access to Affordable Mortgages Act —a new wave of liar loans—because 4% interest rates are simply too high.ref 370 The Postal Service is losing billions and maxed out its available credit lines (but otherwise runs pretty well in my opinion), prompting Congress to vote a stay of execution on all post offices.ref 371 Congress pondered a new form of state-sponsored bank—the United States Employee Ownership Bank Act—funded by the taxpayers to loan money to American workers so that they can . . . wait for it . . . “form collectives and buy the companies they work for.” Hmmm...collectives. GovTrack says the chance of enactment is 0%.ref 372 Phew!

The EPA recruits earthy employees who defecate in its hallways.ref 373 A presidential wannabe (Rick Perry) was indicted by a grand jury on two felony counts of blackmail.ref 374 A lobbyist got sent to prison for bribing Harry Reid, who was not indicted, fired, or quite possibly even asked to give the money back.ref 375 Tom Delay's conviction for money laundering, the only conviction of substance of an elected official in recent years, was reversed.ref 376 Phew again! In the category of criminal stupidity, Nancy Pelosi asserted that “every dollar of unemployment insurance benefits increases America’s GDP by as much as $1.90 and could lead to 200,000 new jobs.” It would be safe to say that she ain't gonna be splittin' any atoms.

Away from the hallowed halls of Congress and the Senate, the Veterans Administration had some 'splainin' to do. It seemed to have falsified data to hide healthcare delays for veterans.ref 377 We've been sending our kids to foreign wars and completely failing to patch them up when they return home shot to pieces. An estimated 64,000 vets signed into the VA system during the last decade and never got a first appointment.ref 378 One who had a leg amputated owing to incompetence suggested wryly, “I feel the VA owes me a leg.” Indeed it does. Obama took the heat on the scandal, but this was a bipartisan effort spanning many years.

“All we have of freedom, all we use or know—this our fathers bought for us long and long ago.”

~Rudyard Kipling, “The Old Issue,” 1899

The DOJ spent millions to cover up a clerical error that caused an innocent, wheelchair-bound citizen to be handcuffed as a terrorist.ref 379 Hundreds of millions worth of cargo planes to reinforce the Afghan Air Force were turned to $32K worth of scrap instead.ref 380 Eric Holder could have used a few of 'em: he took 27 personal trips on DOJ planes.ref 381 Elon Musk lost a multi-billion dollar contract when he didn't give a public official a job at SpaceX.ref 382 A sergeant was convicted of accepting $250K in bribes from local Afghan contractors,ref 383 which makes you wonder where those crazy Afghans get their money. Maybe a brisk rug market? David Brat knocked off Eric Canter (figuratively). The big losers are all those folks who've been bribing Canter who now get zip. They will have to continue paying to ensure promises of bribes after leaving office will be taken at face value. The Lannisters always pay their debts. Leaving no issue untainted, the feds cancelled the Washington Redskins trademark.ref 384 It's not the office’s job to do this, but it does prompt some thoughts on a new mascot: the Washington Lobbyists, Criminals, Lightweights, Elites, Kickbacks (which has a nice football ring to it), or, taking a cue from the Miami Heat, the Washington Douche.

The once-reputable SEC continues to underwhelm. Former SEC lawyer James Kidney's farewell letter suggested that his superiors were more focused on getting high-paying jobs after their government service than on bringing difficult cases.ref 385 Ya think? The agency’s penalties, Kidney said, have become “at most a tollbooth on the bankster turnpike” and that the SEC had become “a cancer.” A Zero Hedge poster called it “Kidney Failure.”

The SEC awarded a whistleblower of a big Wall Street bank $14K hush money for his info; they fined the bank without naming it.ref 386 Luis Aguilar noted, “I am concerned that the commission is entering into a practice of accepting settlements without appropriately charging fraud and imposing suspensions.” This statement was prompted by a punishment meted out for a banking fraud case that entailed giving back half a million in bonuses.ref 387 As part of the Dodd–Frank financial overhaul, the Financial Stability Oversight Council was created and was soon in a turf war with the SEC over who is in charge of ignoring financial crimes.ref 388 Jesse Eisinger noted that Mary Jo “MoJo” White was “supposed to turn around the SEC. She hasn’t.”ref 389 MoJo's honor was defended by Yves Smith, who pointed out that “Mary Jo White is no doubt doing her job. It’s simply, as with Obama, not the job the public was led to think she’d do.”ref 390 Maybe the next president—possibly a wizard at trading cattle futures—will bring honor back to the SEC.

Not to be outdone by the SEC, the commissioner of the Chicago Futures Trading Commission, vigilant defender of Wall Street, Scott O’Malia, left the commission to head the International Swaps and Derivatives Association, an enormous lobbying group for the banks.ref 391 This so-called soft corruption—corruption that is real and really hard to convict—continues unabated.

The hilarious stuff occurred at the state level, and the great state of New Jersey, home of buried bodies and Hoboken, took a leadership role. The big one was Bridgegate, wherein a need for political retribution prompted one of Governor Chris Christie's aides to note, “Time for some traffic problems in Fort Lee.”ref 392 Bridges were artificially jammed up for a few days. Commuters did not get the joke, especially the guy who died in the traffic jam. As expected for any presidential hopeful, Christie just couldn't catch a break. The big guy got caught cutting pension contributions by 60% to close a budget gapref 393 while allocating $200 million to a hedge fund that, by chance, had given him a $250K campaign donation.ref 394 All told, the state’s taxpayers lost an estimated $3.8 billion to the governor's largesseref 395 (presumably including some portfolio losses). The Wall Street boys and girls garnered $938 million in fees alone.ref 396 Alas, the statute of limitations on such vente larceny is 10 minutes.

A number of other state civil servants won participation awards. Former New Orleans Mayor Ray Nagin of Katrina fame was sentenced to a decade in prison (or until a last-minute pardon from Obama) for bribery.ref 397 Rahm Emanuel got $100K from Comcast and then, shockingly, supported its merger with Time-Warner.ref 398 Governor Andrew Cuomo announced he would disband the Moreland Commission formed to investigate corruption in Albany.ref 399 Nixon rolled in his grave. By this standard, he was not a criminal.