- Chinese Stock Plunge Leaves State Media Speechless (BBG)

- China’s Market Selloff Accelerates (WSJ)

- Any Deal on New Greek Bailout Funds Put Off Until Weekend (WSJ)

- ECB keeps ELA funding limit for Greece unchanged for third day in a row (Reuters)

- Impoverished Greek City Stands With Alexis Tsipras (WSJ)

- Why It Won’t Be a Default If Greece Misses IMF Payment Next Week (BBG)

- Valeant Makes Takeover Approach to Zoetis (WSJ) - or how Ackman assures himself another good T+3 quarter

- From Deutsche Bank to Siemens: What's Troubling Germany Inc.? (BBG)

- Obamacare ruling puts Supreme Court on hot seat in U.S. presidential race (Reuters)

- IAC/InterActive Plans an IPO for Its Matchmaking Business (WSJ)

- Brooklynites Can Work Near Home as Offices Start to Rise (BBG)

- Russia 'playing with fire' with nuclear saber-rattling: Pentagon (Reuters)

- Japan’s Economy to Grind to a Halt in 2nd Quarter, JPMorgan Says (BBG)

- Chief Justice John Roberts Charts Own Path, Frustrating Right Again (WSJ)

Overnight Media Digest

WSJ

* European finance chiefs pushed off talks to seal a Greek bailout deal until the weekend, leaving only days to keep Athens from defaulting on a loan payment early next week. (http://on.wsj.com/1TOENoD)

* The Supreme Court, in a 6-3 vote, ruled the Obama administration can continue to subsidize health-insurance purchases by lower-income Americans in all states, preserving a centerpiece of the Affordable Care Act. (http://on.wsj.com/1HjvyYi)

* The FCC is proposing to close a loophole in wireless auctions that let partners of Dish Network Corp claim $3.3 billion in discounts intended for small businesses. (http://on.wsj.com/1LH9Blq)

* Valeant Pharmaceuticals International Inc has made a preliminary approach to buy animal-health giant Zoetis Inc, people familiar with the matter said. (http://on.wsj.com/1fGK2qC)

* Canadian mining giant Potash Corp of Saskatchewan Inc offered to take over K+S AG in a deal that, if successful, would create a company capable of dominating a big chunk of the global market for the fertilizer. (http://on.wsj.com/1eKOCEm)

* IAC/InterActiveCorp unveiled plans to pursue an IPO of its Match Group division, which includes dating site Match.com and dating app Tinder. (http://on.wsj.com/1RztLQd)

* Molycorp Inc filed for protection from creditors, becoming the biggest corporate failure in a bleak year for a mining industry. (http://on.wsj.com/1RzoPL7)

FT

Co-founder of digital invoicing company Tungsten Corp Plc , Edi Truell may take the company private from London's Aim stock exchange, after growing frustrated with short sellers.

Canadian fertilizer producer Potash Corp of Saskatchewan Inc said it made a "private proposal" to buy German rival K+S for about $7 billion.

South African police have been slammed for their role in killing 34 striking miners in 2012, after a report on the killings came out. This may call out for a further probe on the criminal liability of the officers involved in the killings.

Amazon.com Inc is focussing on getting its deliveries and logistics right in order to snatch business from physical stores. Hitting the 10,000 employee mark for the first time since its launch in 2013, the online retailer is targeting to provide same-day deliveries for products.

NYT

* The U.S. Federal Communications Commission on Thursday rejected calls to dedicate more airwaves for smaller wireless carriers in an auction expected next year. Tom Wheeler, the chairman of the FCC, wrote in a blog post that he wanted to keep the level sold exclusively to smaller carriers at the level agreed to last year. T-Mobile US Inc and other smaller wireless carriers lobbied for months to increase the size. (http://nyti.ms/1NlcauR)

* The U.S. House of Representatives gave final approval on Thursday to a significant expansion of aid to workers displaced by global competition, sending to President Barack Obama the second half of a trade package that House Democrats had dramatically rejected just two weeks ago. (http://nyti.ms/1CxPLUF)

* Charter Communications Inc, in an attempt to distinguish itself from Comcast and its failed takeover of Time Warner Cable Inc, promised federal regulators on Thursday that a pair of deals totaling $67.1 billion would pose no threat to the growing market for online video because the combined company's future depended more on broadband than on its legacy video business. (http://nyti.ms/1CxOVHz)

* Taylor Swift said on Thursday that she would stream her latest album, "1989," on Apple Inc's new music service, apparently ending her brief dispute with the tech giant. (http://nyti.ms/1SP9KHP)

* For the first time since a crisis erupted over deadly defects in airbags made by his family's company, the reclusive chief executive of the Japanese supplier Takata Corp publicly addressed the issue on Thursday. He offered an apology but defended Takata's products as fundamentally safe. (http://nyti.ms/1GvUDLB)

* Lululemon Athletica Inc said on Thursday that it would recall elastic drawstrings in about 318,000 women's tops that could snap back and cause eye and face injuries. (http://nyti.ms/1KePjkH)

* Irate taxi drivers blocked roads, burned tires and attacked drivers who they thought were working for Uber, the ride-hailing company, during a day of protests Thursday that disrupted Paris and slowed traffic to a crawl. The strike in France is the latest in a series of challenges confronting Uber, which is based in San Francisco, in a number of European countries in which it operates. The taxi associations here oppose the company's efforts to expand its low-cost UberPop service. (http://nyti.ms/1NhcJVK)

Canada

THE GLOBE AND MAIL

** Canada's federal government is preparing a financial compensation package for Canadian dairy and poultry farmers as a way to blunt the impact of signing onto a massive Pacific Rim trade deal which could allow a surge of agricultural imports

from other countries. (http://bit.ly/1J9l50X)

** Sobeys Inc is preparing to shave 1,300 jobs in the wake of its takeover of Safeway Canada as the country's second-largest grocer looks to consolidate its distribution and office operations and cut costs. (http://bit.ly/1IhmGmN)

** Alberta's plan to increase carbon fees and toughen its climate strategy adds costs and more uncertainty to an industry already struggling to cope with the sharp plunge in oil prices. (http://bit.ly/1RC7P6S)

NATIONAL POST

** Potash Corp of Saskatchewan Inc submitted a written proposal to buy German fertilizer giant K&S AG , just two years after its last effort failed. The Saskatoon-based company. According to reports, the offer is in the neighbourhood of $8 billion. (http://bit.ly/1IhmYtZ)

** HarperPAC, a conservative third-party group, has announced it is shutting down operations less than a week after its launch. HarperPAC was formed by a team of Conservatives including several former political staffers. Its efforts included a radio ad that targeted Liberal Leader Justin Trudeau. (http://bit.ly/1Hks2g9)

Hong Kong

SOUTH CHINA MORNING POST

-- Beijing's top representative in Hong Kong on Thursday night hailed pro-establishment lawmakers' support for the electoral reform package and did not take them to task for the botched walkout before the vote last week. The news emerged from a "tea gathering" for 40 Beijing loyalists that also saw an unusually warm reception for the media pack. (bit.ly/1QSgmI1)

-- The government received no dividend from the HK$7 billion ($903.09 million) profit made by the Airport Authority in the last financial year, as it prepares to build a HK$140 billion third runway, its annual report shows. (bit.ly/1KfKokN)

-- Hong Kong's stock market watchdog, Securities and Futures Commission, said it did not support a draft proposal to allow companies to issue weighted voting rights, a week after the markets operator, Hong Kong Exchanges and Clearing, said it would launch a second round of consultation on the contentious topic later this year. (bit.ly/1LykgSB)

THE STANDARD

-- Legislative Council President Jasper Tsang Yok-sing has apologised for taking part in a WhatsApp group chat on last week's political reform vote, but denied violating the principle of neutrality. He said his participation in the group chat was aimed at facilitating the motion debate so that the vote would not end up taking place at night. (bit.ly/1Lt5XxU)

-- Several pan-democrat lawmakers have turned to the instant messaging app Telegram following the fallout from the WhatsApp scandal that has gripped the pro-establishment camp. Telegram allows users to exchange messages just like WhatsApp, and can set up "secret chats" that offer end-to-end encryption with no trace of the message and users can set up self-destruct timers on messages. (bit.ly/1BFdt6m)

-- Restaurant chain Tsui Wah Holdings posted a flat profit last financial year despite robust growth in revenue, highlighting local eateries' wrestling with soaring rent and labour costs. For the year ending March, net profit edged up just 0.88 percent to HK$157.41 million ($20.31 million). (bit.ly/1NgtaBz)

HONG KONG ECONOMIC TIMES

-- Property group Wharf (Holdings) has won a bid for two residential sites in China's Hangzhou for 1.437 billion yuan ($231.46 million).

Britain

The Times

A tranche of projects was put on hold after it emerged that a 38.5 billion stg ($60.62 billion) investment programme overseen by Network Rail has been ravaged by chronic cost overruns and missed targets. In a sign of the severity of the crisis, Richard Parry-Jones, Network Rail's chairman, was replaced by Peter Hendy, the current transport commissioner of London. (http://thetim.es/1GLRn0U)

Debt management companies may have to pay clients compensation for selling services without considering their financial position and for other misleading practices, after a report by the UK financial regulator Financial Conduct Authority revealed that debt management companies routinely treat customers, especially vulnerable members of society, unfairly.(http://thetim.es/1GLRLN1)

The Guardian

The Scottish government has been accused of trying to bury a report that predicts North Sea oil revenues could be 40 billion stg less than the Scottish National Party's most optimistic forecasts by releasing it the day before Holyrood's summer recess - and after the deadline for emergency questions. (http://bit.ly/1KfFTqH)

More than 2 million stg in bonuses have been given to top managers of Lloyds Banking Group, just weeks after the bank was hit with a 117 million stg fine for mishandling payment protection insurance compensation claims. (http://bit.ly/1fHif9M)

The Telegraph

According to Westminster sources close to the Telegraph, the BBC Trust will be axed and its powers handed to the UK communications regulator Ofcom. (http://bit.ly/1e6Ig0R)

Tesco chief executive Dave Lewis will face shareholders for the first time at the retailer's annual meeting on Friday as they look for answers in a year that saw record losses of 6.4 billion stg and an accounting scandal. (http://bit.ly/1Hir7ii)

Sky News

Tyre manufacturer Goodyear is planning to close its only UK factory, with hundreds of workers facing the axe. All 330 staff at the company's Wolverhampton plant are set to lose their jobs in what the Unite union said would be a "devastating blow" for the area. (http://bit.ly/1RAGDpf)

Amazon.com Inc has sparked further anger over its UK tax bill after it emerged it paid just 11.9 million stg in tax last year despite the group taking 5.3 billion stg in sales. (http://bit.ly/1NkSpDv)

The Independent

The British government has said it plans to sell its stake in the Green Investment Bank, the first bank in the world established to make money out of environmentally sustainable projects. (http://ind.pn/1fHoNVF)

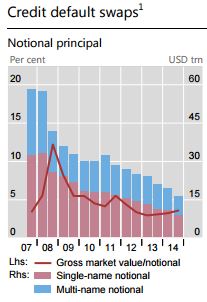

Low interest rates and loose monetary policies are threatening the future of the insurance and pension industries by forcing providers to switch their investments into riskier asset classes, a report by the Organisation for Economic Co-operation and Development has warned. (http://ind.pn/1NdRsfE)